Introduction

Generally speaking, apartment buildings for sale provide more favorable returns than residential properties and are considered a less risky investment. They are less expensive to build, run and maintain on a per unit basis. They do not need the constant attention of the owner to deal with day-to-day routine responsibilities as most buildings have body corporations and professional real estate agencies managing the investment.

An apartment building is a common form of multifamily residential housing or a multi dwelling unit (MDU). Fortunately, there are cost advantages that these enterprises realize when the fixed running costs of the building are spread out over a number of units. This is called ‘economies of scale’ and apartment buildings usually have enough economies of scale to make the professional management costs feasible.

Determining The Value Of Apartment Buildings

Apartment buildings are purchased and sold simply based on their financial value. Not to be too specific, there are a number of ways to value a apartment building. They include:

- To compare similar properties or

- To calculate the value determined by their potential to provide a net cash flow based on the rents being generated.

Capitalization Rate

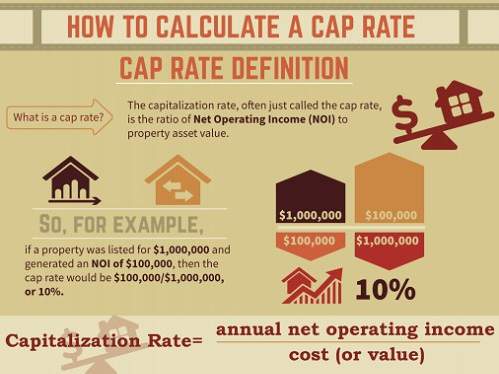

A method used to evaluate the value of a building is by calculating the capitalization rate or “Cap Rate” as it is known.

- Determine the actual income that the property generates.

- Calculate the operating costs minus debt costs.

- Subtract the operating costs from the actual income gives the investor the net operating income (NOI) or annual earnings.

- Determine the asset value of the apartment building for sale

- Divide the NOI by the asset value of the building

In other words, Property Price X Cap Rate% = Earnings (Annual).

The infographic below provides a visual explanation of how the cap rate is calculated.

It is important to know that these earnings are based on having no debt on the apartment building. Property analysts utilize this calculation on a daily basis to compare the value of different buildings, even buildings of different sizes.

How Much Is That Apartment Building Worth?

How do savvy investors use this calculation? It is the simple way to answer the question how much is that property worth. Cap rates are also used to depict the pricing of apartment buildings in a specific market. The rates may vary depending on the location of the building but it enables the investor to gauge the price based on the earnings of the building and the accepted cap rate in the area in the current market.

NOI ÷ Cap Rate % = Price Of The Building

For example, if the investor knows that the apartment building has a net operating income NOI of $500,000 and the accepted cap rate for that building in a certain location is 9%, the investor can calculate how much the building is worth?. In this case it is worth approximately

$400,000 ÷ 9% = $4,450,000

What is the ideal cap rate? I read a good Forbes article Understanding Cap Rates: The Answer is Nine. In this article Brad Thomas surmises that when you have a property portfolio over a period of time, the average cap rate expected is..you guessed it…. 9.

Another key principle in assessing the worth of apartment buildings for sale, as with any real estate, is location. This topic will be discussed in Part 2 of this post when I further discuss what factors determine the value of apartment buildings.

Very informative information there. This will help people look into apartments and sales. Best luck to you on your journey!

Yes thank you Kevin

I have only just scratched the surface so far with this topic. There is a lot more to come in Part 2 and Part 3 of this post.